4 Simple Techniques For Pvm Accounting

The Main Principles Of Pvm Accounting

Table of ContentsAn Unbiased View of Pvm AccountingThe Facts About Pvm Accounting RevealedPvm Accounting Things To Know Before You BuyHow Pvm Accounting can Save You Time, Stress, and Money.Some Of Pvm AccountingThe Ultimate Guide To Pvm Accounting

Oversee and manage the creation and authorization of all project-related billings to clients to cultivate good interaction and stay clear of issues. financial reports. Make sure that ideal reports and paperwork are sent to and are upgraded with the IRS. Guarantee that the audit process abides by the legislation. Apply called for construction bookkeeping criteria and treatments to the recording and reporting of construction activity.Interact with different funding companies (i.e. Title Business, Escrow Business) concerning the pay application process and requirements needed for payment. Assist with implementing and maintaining internal financial controls and procedures.

The above statements are intended to define the basic nature and degree of job being executed by people assigned to this classification. They are not to be construed as an extensive checklist of duties, obligations, and abilities called for. Employees might be needed to execute tasks beyond their typical responsibilities from time to time, as needed.

Pvm Accounting for Dummies

You will certainly help sustain the Accel team to make certain shipment of effective on schedule, on spending plan, jobs. Accel is looking for a Building Accounting professional for the Chicago Office. The Building and construction Accountant does a variety of audit, insurance coverage compliance, and job management. Works both separately and within specific departments to keep financial documents and make sure that all documents are kept present.

Principal obligations consist of, however are not restricted to, handling all accounting features of the company in a prompt and exact manner and offering records and timetables to the business's CPA Firm in the prep work of all financial statements. Guarantees that all audit treatments and features are taken care of accurately. In charge of all financial records, payroll, banking and daily operation of the bookkeeping function.

Prepares bi-weekly trial balance reports. Functions with Job Supervisors to prepare and post all month-to-month billings. Processes and issues all accounts payable and subcontractor payments. Creates month-to-month recaps for Workers Compensation and General Responsibility insurance costs. Produces regular monthly Job Cost to Date records and dealing with PMs to fix up with Project Supervisors' allocate each project.

Indicators on Pvm Accounting You Need To Know

Proficiency in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore building and construction administration software a plus. https://www.evernote.com/shard/s508/client/snv?isnewsnv=true¬eGuid=4404e321-52ad-dbea-8eba-d5e975e5f179¬eKey=IAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&sn=https%3A%2F%2Fwww.evernote.com%2Fshard%2Fs508%2Fsh%2F4404e321-52ad-dbea-8eba-d5e975e5f179%2FIAq1oFQVQ3PnblqtDRJ-taVHQRcX3dvb_wpCe3pFQx9ozoYePcYu7Prtow&title=The%2BUltimate%2BGuide%2Bto%2BConstruction%2BAccounting%253A%2BStreamline%2BYour%2BFinancial%2BProcesses. Need to likewise excel in other computer system software application systems for the prep work of records, spreadsheets and various other bookkeeping evaluation that may be required by administration. Clean-up accounting. Should have solid business abilities and capability to focus on

They are the financial custodians who ensure that building and construction projects stay on budget, adhere to tax obligation policies, and preserve financial transparency. Building and construction accounting professionals are not just number crunchers; they are calculated partners in the building procedure. Their key role is to handle the economic aspects of building tasks, making certain that resources are alloted efficiently and financial dangers are decreased.

The 8-Minute Rule for Pvm Accounting

By keeping a limited grasp on job financial resources, accountants help protect against overspending and economic obstacles. Budgeting is a foundation of successful building and construction tasks, and building accountants are instrumental in this regard.

Browsing the complicated web of tax regulations in the building and construction sector can be difficult. Building accountants are fluent in these guidelines and guarantee that the project adheres to all tax obligation demands. This includes managing payroll taxes, sales tax obligations, and any various other get more tax obligations certain to construction. To succeed in the role of a building and construction accountant, people need a strong instructional foundation in audit and financing.

Furthermore, accreditations such as Licensed Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Industry Financial Professional (CCIFP) are extremely related to in the market. Building jobs commonly entail limited target dates, transforming laws, and unexpected expenses.

Fascination About Pvm Accounting

Specialist certifications like certified public accountant or CCIFP are additionally highly suggested to show experience in building accountancy. Ans: Construction accountants create and monitor budget plans, identifying cost-saving chances and making certain that the job remains within spending plan. They additionally track expenditures and projection financial needs to avoid overspending. Ans: Yes, building accountants take care of tax obligation conformity for building and construction tasks.

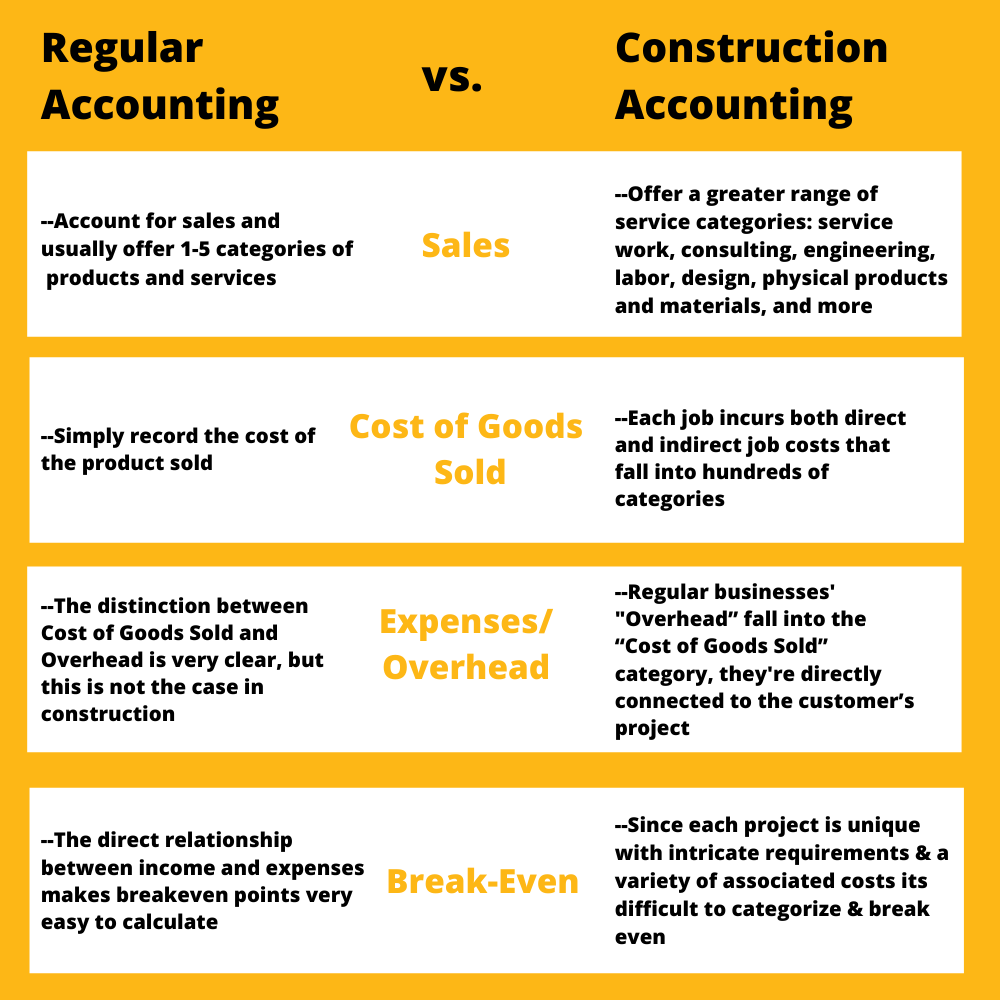

Intro to Building Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make hard selections amongst numerous financial alternatives, like bidding on one task over an additional, selecting funding for materials or equipment, or establishing a job's profit margin. Building and construction is a notoriously unpredictable market with a high failure price, slow time to settlement, and inconsistent money circulation.

Typical manufacturerConstruction organization Process-based. Manufacturing includes repeated procedures with conveniently identifiable costs. Project-based. Manufacturing needs different processes, products, and devices with varying prices. Dealt with place. Manufacturing or manufacturing occurs in a single (or numerous) controlled locations. Decentralized. Each task occurs in a brand-new place with varying website conditions and unique obstacles.

Rumored Buzz on Pvm Accounting

Regular use of various specialized service providers and suppliers affects efficiency and money circulation. Repayment gets here in complete or with normal settlements for the complete agreement quantity. Some part of repayment may be kept up until job completion even when the specialist's job is ended up.

While conventional makers have the benefit of controlled environments and maximized production procedures, building firms need to regularly adapt to each brand-new job. Also somewhat repeatable tasks call for adjustments due to site problems and other aspects.